Lockdown during the 2020 crisis has brought out the best and worst of people.

Surprisingly, most people have complied with the lockdown albeit without much enthusiasm. Meanwhile a minority, discard self-control and are tempted to breach the regulations, risking fines.

Saving with stock market investments for any objective is just as difficult because it needs willpower, self-control and discipline to stay with your plan to achieve what may seem like an abstract and faraway objective.

Life is teeming with examples of how willpower is tough to maintain. Gym memberships and diet clubs, alcoholics anonymous and substance abuse clinics are typical ways people reach out for help with problems of self-control.

Most investors would much rather have £1,000 now than £1,000 the year after next. People prefer to have instant gratification and treat losses differently to gains even if they have the same value. These behavioural biases are a particular problem during market turbulence. According to two distinguished behavioural scientists: “Three years of losses often turn investors with thirty-year horizons into investors with three-year horizons” (1). Fortunately, regular saving, technically known as pound cost averaging, is available as a cure to control behavioral challenges as damaging as these.

Saving for retirement or any other long term objective is hard work precisely because it requires the suspension of desires to consume things right now. Saving regularly helps overcome indecision and procrastination by setting a plan. Pound cost averaging means following a strict investing rule to save mechanically regardless of adverse stockmarket conditions, or the ups and downs of personal incomes.

Some of the most popular regular savings vehicles, with added tax incentives, are pension savings plans, but any investment objective can benefit from the pound cost averaging technique across time and different market conditions. Of course, it can seem so much more difficult to save regularly from a monthly salary, than from a year-end bonus or windfall, even if the invested amounts are identical.

When stockmarkets are unusually volatile, for example during the COVID-19 pandemic, rules about investing have even greater usefulness. Following an investing rule overcomes the temptation to try and time the markets, which can go disastrously wrong if markets whipsaw 10% in a day, as well as incurring trading costs and fees. Pound cost averaging can be a disciplined way to take advantage of volatile markets.

Market volatility, often measured by the VIX index, recently tested record highs. Volatility means stockmarkets are headline news. Investors are tempted to look at their investment accounts more frequently and some investors feel an irresistible urge to place trades. Research (2) suggests risk-taking and stress transform our body chemistry and drive us to irrational exuberance or pessimism.

Studies (3) even suggest female investors outperform male investors and researchers trace this outperformance to the fact that women trade their accounts less frequently than men and suffer less damaging overconfidence. So rules are very useful when first lines of defence of your investment plan in enforcing self-control are in danger of failing. Pound cost averaging offers a rule to by-pass many common investing missteps.

Explainer: Pound Cost Averaging

Investing should always be for the long term. Particularly in volatile markets, drip-feeding investments can be a more successful approach than a one-off investment.

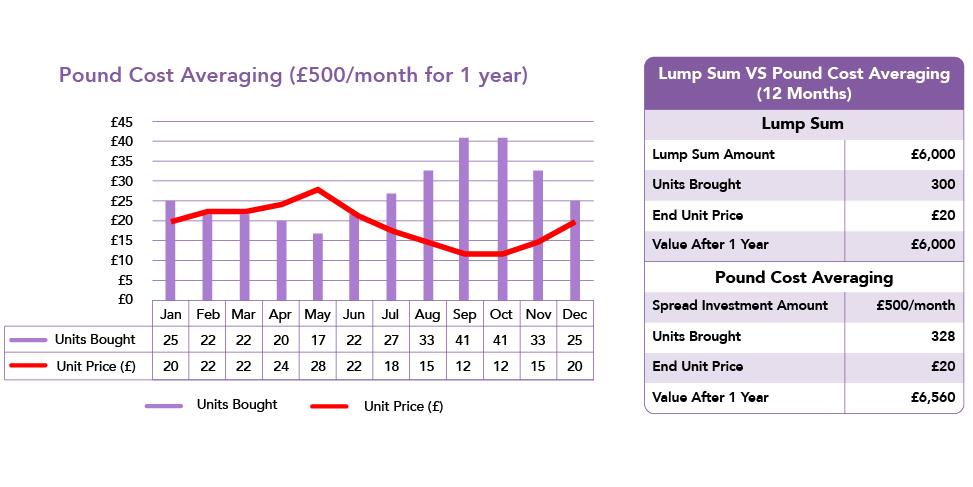

In our example table you can see a comparison between investing in units of a notional investment with a lump sum of £6,000 and investing £500 per month over 12 calendar months. Even though the underlying price of the units ends the same as at the start of the year (£20) because of market volatility the pound cost averaging approach beats the lump sum approach hands down. Diversifying across time in this way should allow your investments to dampen the impact of market volatility with ease.

(1) A Behavioral Framework for Time Diversification, Financial Analysts Journal, Kenneth Fischer and Meir Statman, May/June, 1999.

(2) The Hour between Dog and Wolf: Risk Taking, Gut Feelings, and the Biology of Boom and Bust, John Coates, 2013.

(3) Boys Will be Boys: Gender, Overconfidence, and Common Stock Investment, Brad M. Barber and Terrance Odean, The Quarterly Journal of Economics, Vol. 116, No. 1 (Feb, 2001), pp. 261-292.

Past performance is not a reliable indicator of future results. The value of investments, and the income from them may fall or rise and investors may get back less than they invested.